Not known Factual Statements About Summitpath Llp

Table of ContentsMore About Summitpath LlpFacts About Summitpath Llp RevealedSummitpath Llp - The FactsThe 7-Second Trick For Summitpath Llp

Most recently, introduced the CAS 2.0 Practice Advancement Training Program. https://www.empregosaude.pt/author/summitp4th/. The multi-step training program consists of: Pre-coaching placement Interactive team sessions Roundtable conversations Individualized mentoring Action-oriented mini plans Companies wanting to expand right into advising services can additionally turn to Thomson Reuters Method Forward. This market-proven method supplies web content, devices, and guidance for companies thinking about advising solutionsWhile the modifications have unlocked a number of growth chances, they have actually also resulted in obstacles and issues that today's firms require to have on their radars. While there's variance from firm-to-firm, there is a string of usual obstacles and problems that often tend to run industry large. These include, however are not restricted to: To stay affordable in today's ever-changing governing environment, firms have to have the ability to swiftly and efficiently carry out tax obligation study and improve tax obligation reporting performances.

Driving better automation and making sure that systems are snugly incorporated to streamline workflows will certainly assist alleviate data transfer concerns. Firms that remain to run on siloed, heritage systems danger wasting time, money, and the trust of their customers while enhancing the possibility of making mistakes with hands-on entrances. Leveraging a cloud-based software application remedy that functions flawlessly with each other as one system, sharing information and procedures across the firm's workflow, could prove to be game-changing. Furthermore, the brand-new disclosures might cause a boost in non-GAAP measures, historically an issue that is highly inspected by the SEC." Accountants have a whole lot on their plate from governing adjustments, to reimagined organization versions, to a boost in client expectations. Equaling all of it can be difficult, but it does not need to be.

Getting The Summitpath Llp To Work

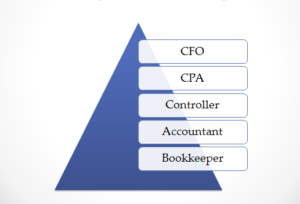

Listed below, we describe four certified public accountant specialties: taxes, administration accountancy, monetary coverage, and forensic accounting. Certified public accountants concentrating on taxes aid their customers prepare and file tax obligation returns, lower their tax obligation burden, and prevent making mistakes that might cause costly penalties. All Certified public accountants need some expertise of tax legislation, yet focusing on taxation implies this will certainly be the focus of your job.

Forensic accounting professionals usually begin as basic accountants and move into forensic bookkeeping functions over time. CPAs who specialize in forensic audit can occasionally relocate up into monitoring bookkeeping.

No states require an academic degree in accountancy. Nonetheless, an audit master's level can aid trainees meet the CPA education and learning need of 150 credit scores because many bachelor's programs just call for 120 debts. Bookkeeping coursework covers subjects like financing - https://medium.com/@josehalley18/about, bookkeeping, and taxation. As of October 2024, Payscale reports that the average yearly income for a CPA is $79,080. bookkeeping service providers.

Accounting additionally makes functional feeling to me; it's not just theoretical. The CPA is a vital credential to me, and I still obtain proceeding education credit scores every year to maintain up with our state requirements.

The Definitive Guide for Summitpath Llp

As an independent expert, I still use all the standard structure blocks of bookkeeping that I learned in college, pursuing my CPA, and operating in public bookkeeping. Among the important things I really like about bookkeeping is that there are many various tasks offered. I determined that visite site I intended to start my profession in public accounting in order to learn a lot in a brief amount of time and be revealed to different kinds of customers and different areas of bookkeeping.

"There are some work environments that don't intend to consider a person for an accounting function that is not a CPA." Jeanie Gorlovsky-Schepp, CERTIFIED PUBLIC ACCOUNTANT A CPA is a really useful credential, and I intended to position myself well in the industry for different tasks - affordable accounting firm. I made a decision in college as a bookkeeping significant that I wished to attempt to obtain my CPA as quickly as I could

I have actually fulfilled lots of terrific accountants that don't have a CERTIFIED PUBLIC ACCOUNTANT, but in my experience, having the credential actually aids to advertise your experience and makes a difference in your compensation and occupation options. There are some offices that don't want to think about someone for a bookkeeping role who is not a CERTIFIED PUBLIC ACCOUNTANT.

5 Easy Facts About Summitpath Llp Explained

I actually delighted in functioning on different kinds of tasks with different clients. In 2021, I made a decision to take the next action in my bookkeeping occupation trip, and I am now a freelance audit consultant and service expert.

It remains to be a development area for me. One vital top quality in being a successful certified public accountant is really respecting your clients and their organizations. I like collaborating with not-for-profit customers for that very factor I seem like I'm actually adding to their mission by assisting them have good monetary details on which to make wise service decisions.